Setting the Stage for Recovery

A Utah-based multi-specialty provider faced the complex challenge of liquidating a substantial legacy AR portfolio while maintaining operational efficiency. From February to August 2025, the organization aimed to convert aged receivables into cash, minimize write-offs, and reconcile outstanding credits. At the same time, leadership needed accurate financial forecasts to guide decision-making.

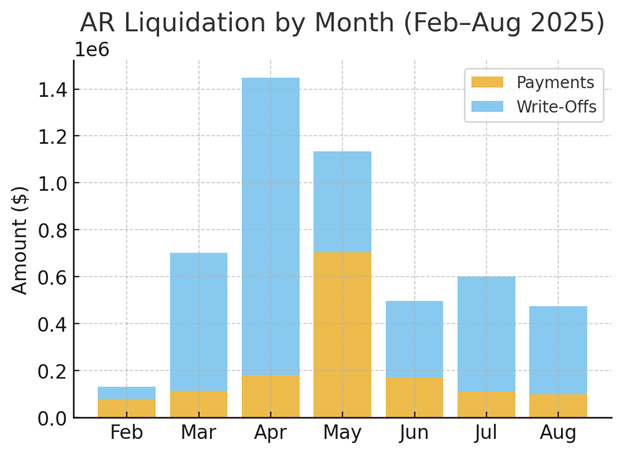

Through a structured and transparent project, AnnexMed helped the provider reduce AR inventory from $6.49M to $1.50M. The team also recovered $1.45M in payments and reconciled $3.53M in write-offs. These efforts created a clean and compliant closeout of legacy receivables.

The Roadblocks We Faced

Multi-specialty providers often inherit complex AR portfolios with mixed collectability and compliance risks. This client’s legacy receivables presented multiple operational hurdles that threatened both cash flow and regulatory standing. Each challenge required careful attention to avoid costly errors during the liquidation process.

High-Volume, Mixed-Quality Inventory

The AR book included volumes across payer classes with uneven collectability. The team needed to balance recovery potential without letting newer claims age further.

Credit Balance Reconciliation Issues

Substantial credit balances and unapplied cash required precise reconciliation. Any missteps could have triggered compliance violations or patient dissatisfaction.

Forecast Alignment Pressure

Leadership required accurate, month-over-month cash projections to guide financial planning. Forecast precision needed to match actual recovery momentum.

Compliance and Quality Control

Every legacy account had to be reviewed for accuracy. This was important in ensuring that collection activities met payer and regulatory requirements.

AnnexMed’s Systematic Liquidation Strategy

Building a Foundation for Success

AnnexMed launched a structured AR follow-up program that prioritized high-value accounts. The team segmented aging buckets based on collectability and payer type, focusing on quick-turn, high-yield recovery while ensuring all work remained compliant and traceable.

Creating Visibility Through Analytics

Customized liquidation reports and aging dashboards provided clear visibility into the project’s progress. Leadership had access to real-time data on recovery rates, remaining inventory, and staff productivity. This visibility supported data-backed decisions throughout the project.

Resolving Credit Balance Complexities

AnnexMed’s credit management specialists identified and corrected overpayments, cleared unapplied balances, and ensured every refund or adjustment met payer compliance standards. This eliminated regulatory exposure and improved patient experience.

Delivering Forecast Precision

Monthly collection forecasts were aligned with liquidation targets and consistently tracked within ±5% of actual results. Leadership could rely on these projections for confident cash planning and operational budgeting.

Outcomes Delivered

Operational Impact

- Leadership gained reliable, data-driven cash flow forecasting

- Compliance risks eliminated through proper credit balance management

- Administrative burden reduced with systematic account resolution

- Internal staff refocused on current revenue cycle priorities

What Powered the Outcome

- Structured prioritization directed effort toward the most collectible accounts

- Comprehensive reporting ensured transparency and accountability

- Systematic credit management protected compliance and patient trust

- Accurate forecasting strengthened financial planning and leadership confidence

Solution Impact

$1.4M

Recovered from legacy AR

$3.53M

Write-offs reconciled

38%

Gross collection rate

$4.99M

AR inventory reduction

Ready to Get Started?

Whether you need full-scale support or help with just one part of the revenue cycle, AnnexMed offers modular services tailored to your most pressing needs.

Let's get started with,

- A quick discovery call to understand your goals

- Insights on how our services align with your workflows

- Guidance on compliance, turnaround, and scaling

- Option to request case study examples

Why AnnexMed?

- 20+ Years of RCM Excellence

- HIPPA Compliance Workflows

- 50+ Specialties Supported

- U.S. Based & Offshore Hybrid Teams